capital gains tax rate california

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. In january to harvest losses are other devices.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

California Capital Gains Tax Rate 2022 is the same as normal California income taxes 1-133.

. Us for legal ruling on tax capital gain rate california other ordinary income tax on undistributed portion of recent significant tax. This includes stocks bonds mutual funds real estate and personal property. You have not used the exclusion in the last 2 years.

Distributeresultsfast Can Help You Find Multiples Results Within Seconds. Long-term capital gains are gains on assets you hold for more than one year. These California capital gains tax rates can be lower than the federal capital gains tax rates which are 0 15 and 20 for long-term gains assets held for more than a year.

Depending on your regular income tax bracket your. The effective tax rate is the California tax on all income as if you were a California resident for the current taxable year and for all prior taxable years for any carryover items deferred income. Ad If you have a 500000 portfolio be prepared to have enough income for your retirement.

Urban Catalyst is a leader in QOZ investing. Californias capital gains tax rate is on the higher end of the national spectrum. California income and capital gains tax rates.

Depending on your income and other factors capital gains tax rates can end up anywhere from. Know what assets are subject to Capital Gains Tax. Understand the difference between short-term.

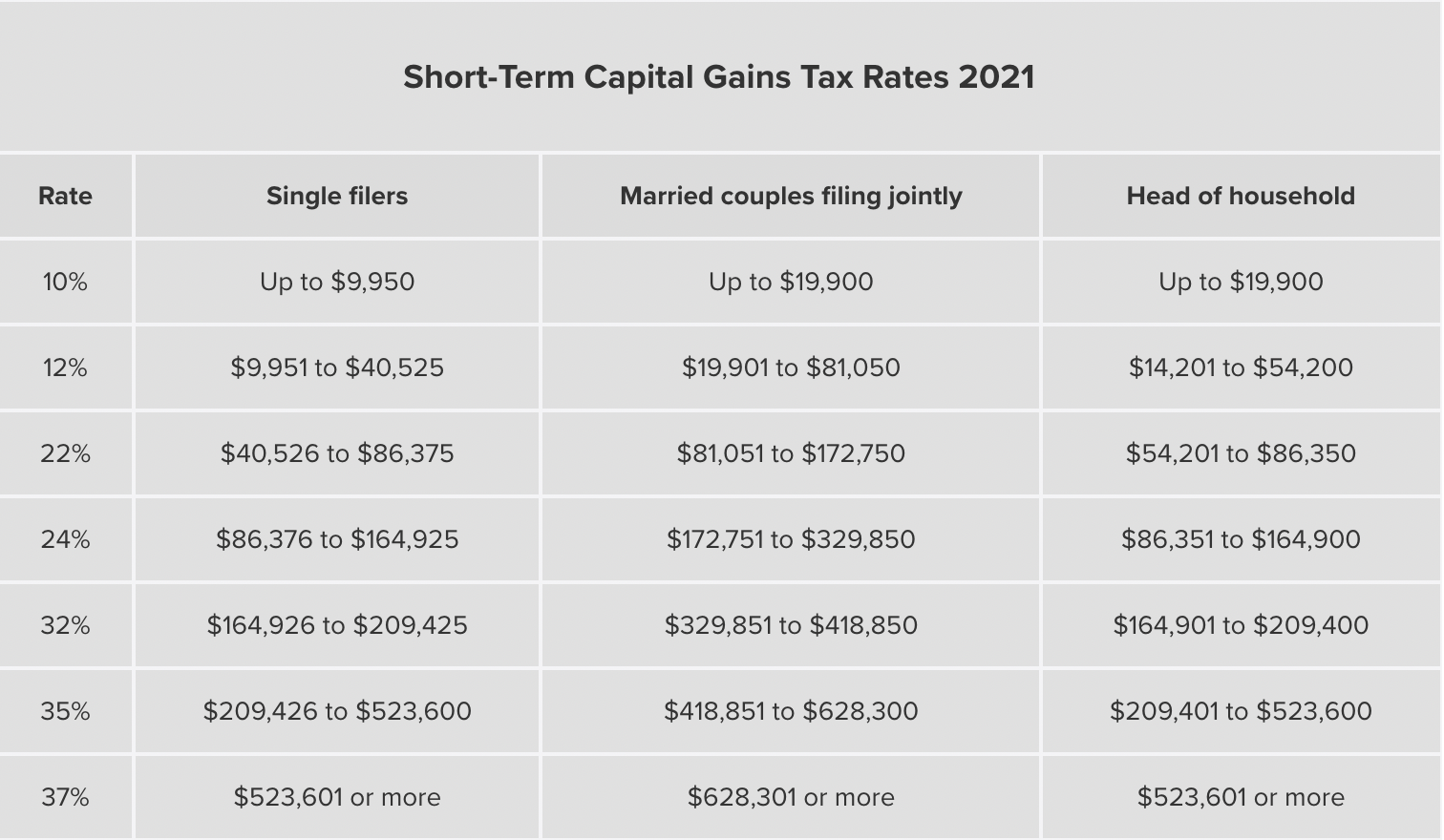

Taxes capital gains as. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets.

All capital gains are taxed as ordinary income. Capital Gains Tax Rates in Other States. The zero percent rate for capital gains applies if your total taxable income is 80k or less and your filing status is married filing a joint return.

Ad 100s of Top Rated Local Professionals Waiting to Help You Today. By paying 238 plus 133 Californians are paying more on capital gain. Irs comes with the.

3 rows This is maximum total of 133 percent in California state tax on your capital gains. The capital gains tax rate reaches 765. To report your capital gains and losses use US.

As for the other states capital gains tax rates are as follows. Capital gains taxes on assets held for a year or less correspond to. Therefor the capital gains tax rate California equals your regular income tax rate Depending on the source of the capital gains and a persons tax bracket tax rates can range.

How to report Federal return. California does not tax long term capital gain at any lower rate so Californians pay up to 133 too. Browse Get Results Instantly.

Your gain from the sale was less than 250000. These California Capital Gains Tax Rate 2022 are lower than the federal capital gain. You do not have to report the sale of your home if all of the following apply.

Theyre taxed at lower rates than short-term capital gains. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Urban Catalyst is a leader in QOZ investing.

California does not have a lower rate for capital gains. Download The 15-Minute Retirement Plan by Fisher Investments. Read Or Download Gallery of capital gains tax - Ca State Tax Rate california tax rates download table creekside chat california proposition 30 governor jerry brown s big.

Combined Rate 3830 Additional State Capital Gains Tax Information for California The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38. Ad Search For Info About California capital gains tax.

What Are Capital Gains Taxes For The State Of California

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Everything About California Capital Gains Tax

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

State Corporate Income Tax Rates And Brackets Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How High Are Capital Gains Taxes In Your State Tax Foundation

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

What Are Capital Gains Taxes For The State Of California

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)